Media

MCB project and share price has big upside: Study

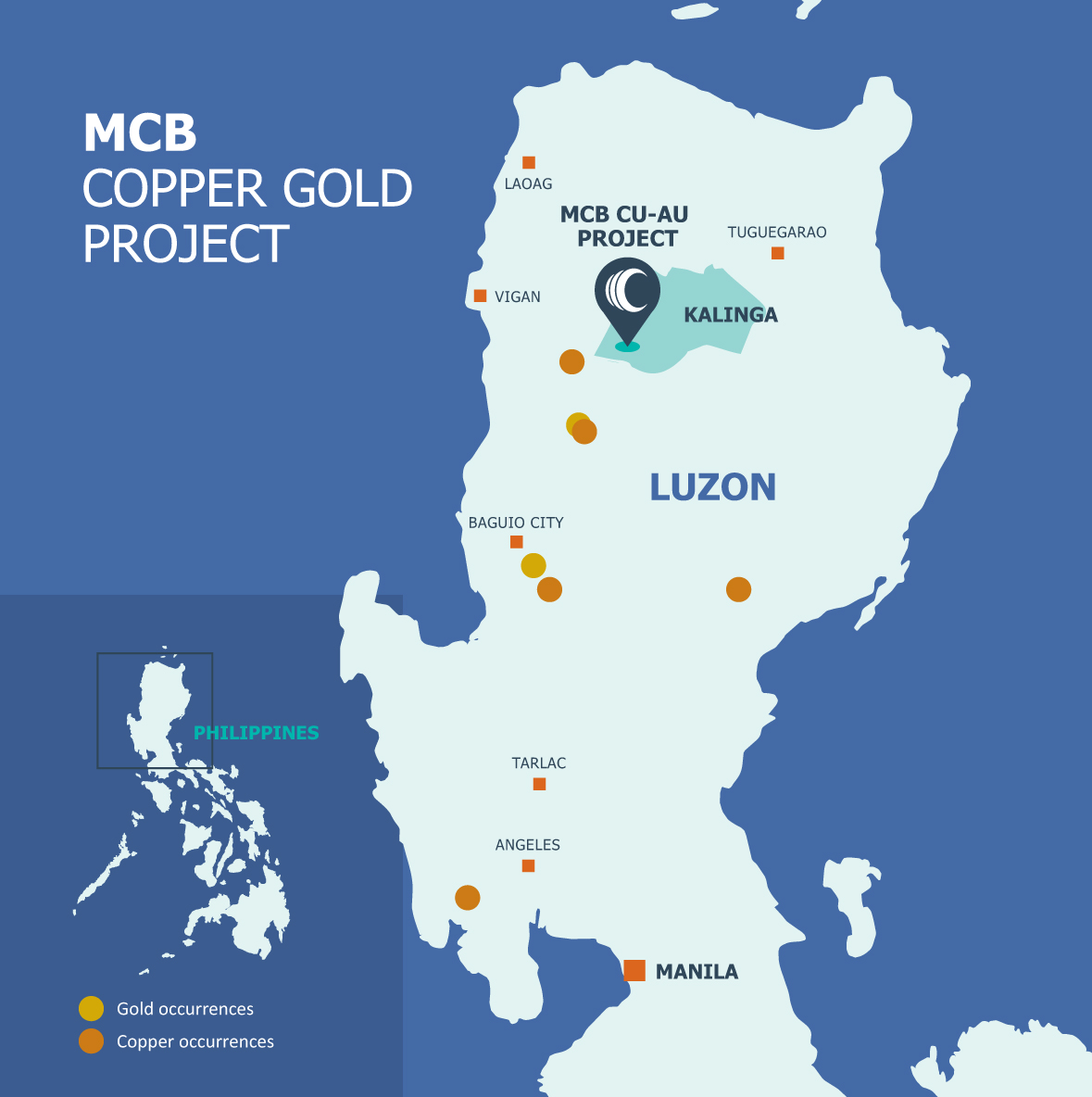

London based broker, Alternative Research Capital has revealed the low-cost development credentials of our flagship MCB Project*.

“The MCB scoping study confirms our view that the project holds potential to emerge as a low-cost, long-life copper-gold operation for a capital outlay that is modest by the standards of porphyry projects globally (and which therefore has realistic scope for independent funding).

Indeed, the robust economics (the study envisages C1 cash costs over the first ten years at just US$0.73/lb copper, net gold credits) could offer the potential for the project to be significantly debt levered – the scoping study concludes that the US$253m estimated initial capital outlay could be recovered in under three years at commodity prices below current spot levels.

Yet Celsius’ market valuation languishes at a heavy discount to both the US$464m NPV concluded by the study and market peers (most of whom have much more capital-intensive projects). The scoping study should kick start a deserved re-rating, with additional catalysts over the coming months as Celsius progresses full feasibility work and further explores both MCB and its wider portfolio of prospective ground in the Philippines.”

Please click here to read more.

*Celsius Resources is a research client of Alternative Resource Capital, a trading name of Shard Capital Partners LLP which is authorised and regulated by the Financial Conduct Authority (FRN: 538762). This is a marketing communication, intended for qualified and professional investors only, and has not been prepared in accordance with legal requirements to promote the independence of investment research. Please read important disclaimers at the end of the linked document.